views

Goods and Services Tax (GST) has transformed the way businesses in India handle taxation. Introduced to streamline indirect taxes, GST has created a unified tax system that simplifies compliance and brings transparency. One of the key aspects of GST compliance is filing returns. But many businesses and individuals often ask, “How do you calculate GST return?” The process might seem technical at first glance, but with proper tools and understanding—like using a GST Refund Calculator—you can easily stay compliant and even claim refunds when eligible.

This article explains the entire GST return calculation process, including where it is applied, the benefits of filing returns correctly, step-by-step guidance, the types of GST returns, and a helpful FAQ section.

Where Does GST Return Apply?

GST return filing is mandatory for:

- Businesses with an annual turnover exceeding the threshold limit (₹20 lakh for most states, ₹10 lakh for NE and hill states).

- Registered suppliers under GST.

- Input Service Distributors.

- Taxpayers under the composition scheme.

- E-commerce operators and aggregators.

- Non-resident taxable persons.

Whether you are a small trader or a multinational corporation operating in India, if you are registered under GST, you are legally required to file periodic returns.

Advantages of Filing GST Returns Accurately

Calculating and filing GST returns accurately offers several advantages:

- Claiming Input Tax Credit (ITC): You can claim ITC on the tax paid on purchases, reducing your overall tax liability.

- Avoiding Penalties: Accurate filing prevents interest, late fees, and penalties.

- Legal Compliance: It helps businesses remain compliant with GST laws, improving credibility.

- Faster GST Refunds: Timely and correct return filing ensures faster processing of GST refunds using a GST Refund Calculator.

- Improved Cash Flow: Efficient return management leads to better cash flow by minimizing blocked capital in taxes.

- Business Growth: Compliance is often a prerequisite for working with larger enterprises or government tenders.

Step-by-Step: How to Calculate GST Return

To calculate your GST return properly, follow these simple steps:

Step 1: Collect Tax Invoices

Start by collecting all invoices for:

- Sales (Outward Supplies)

- Purchases (Inward Supplies)

- Expenses

- Credit/Debit Notes

Step 2: Segregate Tax Components

Every invoice under GST includes:

- CGST (Central GST)

- SGST (State GST) or UTGST (Union Territory GST)

- IGST (Integrated GST)

Split the tax amounts accordingly based on intra-state or inter-state transactions.

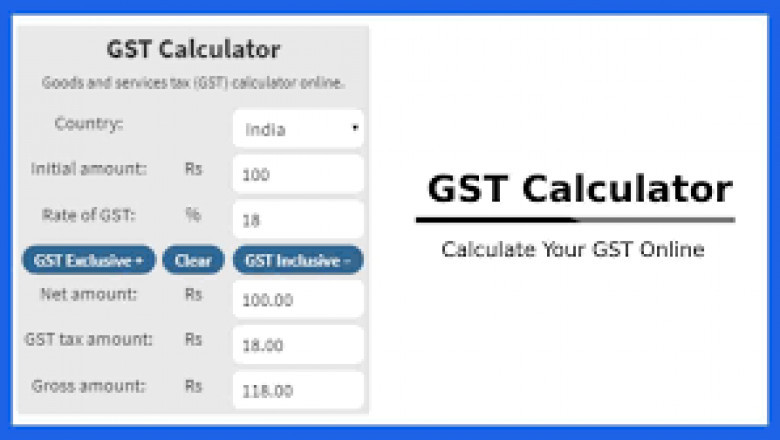

Step 3: Use a GST Refund Calculator

A GST Refund Calculator helps in calculating:

- Excess tax paid

- ITC (Input Tax Credit)

- Eligible refund amount

Just enter your tax paid and ITC claimed, and the calculator gives you the net refund (if any).

Step 4: Compute Output Tax Liability

Sum up the GST collected on sales (output tax). This is the amount you owe the government.

Step 5: Calculate Input Tax Credit

Add the total GST paid on purchases (input tax). This is the amount you can claim as credit.

Step 6: Determine Net Tax Liability or Refund

Net GST Payable = Output GST - Input GST

- If the output GST > input GST: Pay the balance.

- If the input GST > output GST: You can claim a refund.

Step 7: File the GST Return Form

Based on your registration type and turnover, file the appropriate GST return form through the GST portal

Step 8: Reconcile Monthly and Annually

Ensure your books match the returns filed. Reconciliation is key to avoiding future disputes and notices.

Types of GST Returns in India

Depending on the nature of your business and turnover, you may need to file one or more of the following types of GST returns:

|

Return Form |

Purpose |

Frequency |

|

GSTR-1 |

Details of outward supplies |

Monthly/Quarterly |

|

GSTR-2A / 2B |

Auto-drafted details of inward supplies |

Monthly |

|

GSTR-3B |

Summary of sales and ITC claimed |

Monthly |

|

GSTR-4 |

For composition scheme taxpayers |

Quarterly |

|

GSTR-5 |

For non-resident taxable persons |

Monthly |

|

GSTR-6 |

Filed by Input Service Distributors |

Monthly |

|

GSTR-7 |

Filed by TDS deductors |

Monthly |

|

GSTR-8 |

Filed by e-commerce operators |

Monthly |

|

GSTR-9 |

Annual return |

Annually |

|

GSTR-10 |

Final return when GST registration is cancelled |

Once |

|

GSTR-11 |

For UIN holders to claim refund |

Monthly |

Each return form serves a different purpose, so make sure to file the correct one as per your category.

Conclusion

Calculating your GST return is a crucial part of tax compliance for every registered taxpayer in India. While the process involves collecting invoice data, computing input and output taxes, and reconciling records, it becomes much easier with tools like a GST Refund Calculator.

Understanding the return types and filing them timely not only ensures you stay on the right side of the law but also helps claim legitimate refunds, improve your business’s financial health, and maintain a trustworthy image.

FAQs

Q1: What is a GST Refund Calculator?

A GST Refund Calculator is an online tool that helps businesses calculate the refund amount they are eligible for under GST by entering sales, purchases, and tax details.

Q2: When can I claim a GST refund?

You can claim a refund when:

- Input tax credit exceeds output tax.

- Export without payment of IGST.

- Inverted duty structure (higher tax on inputs).

- Excess tax paid due to error.

Q3: Is GST return filing mandatory?

Yes, every registered taxpayer under GST must file returns even if there is no business activity (nil return).

Q4: What happens if I don’t file my GST return on time?

You will be liable for:

- Late fee: ₹50/day (₹20/day for nil returns).

- Interest: 18% per annum on the unpaid tax amount.

Q5: Can I revise a GST return?

No. GST returns once filed cannot be revised. However, you can rectify mistakes in the subsequent month’s return.

Q6: How do I know if I am eligible for a GST refund?

Use a GST Refund Calculator or consult a GST expert. You’re eligible if your input tax credit is more than output tax, or in cases like exports, deemed exports, or inverted tax structure.

Q7: Is manual calculation of GST returns advisable?

It’s not recommended due to complexity and risk of error. Use the official GST portal or software tools like GST Refund Calculator for accurate results.

Comments

0 comment